Complete The Identification Process

The Bank of the Republic of Haiti (BRH), which is the regulator of the mobile financial services sector, requires all customers of electronic payment service providers to be identified. MonCash asks all its customers to provide a valid identification in their registration process.

MonCash invites and encourages its customers to identify themselves in order to continue using the system.

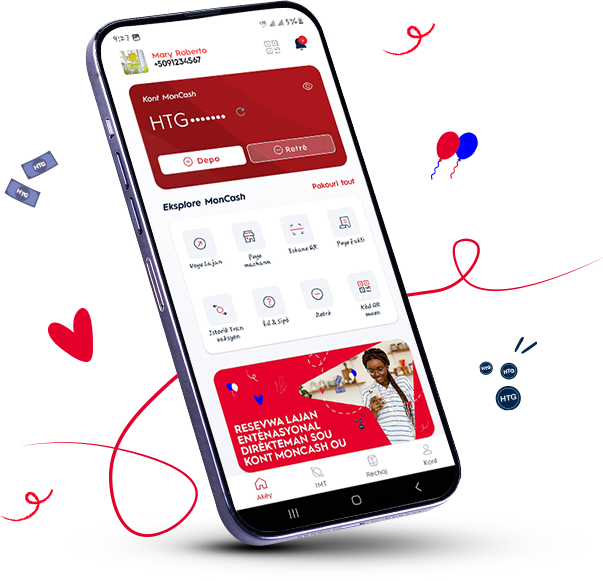

Use the MonCash Application, follow the instructions to fill out the form, submit a valid ID that can be a License, an Electoral Card or a Passport, and submit a photo of yourself (selfie) on the same application;

Go to any Digicel Store with your phone and a valid ID;

You can approach one of the MonCash employees who will be available in many places in the country to help you identify your account;

Send an email to ClientsMonCash@digicelgroup.com with your ID and phone number;

Wait for an SMS from an official MonCash number giving details of the entries and a link.

Users are encouraged to complete the authentication process to continue using their account.

MonCash is complying with new regulations set by the Central Bank of Haiti (BRH). According to Circular 121, all customers of electronic payment service providers must be fully identified. As part of this requirement, MonCash users must complete the identification process by providing a valid ID. This measure is designed to enhance security and ensure that all transactions are legitimate.

To comply with Circular 121 issued by the Bank of the Republic of Haiti (BRH), all MonCash users must be registered with a valid ID before July 1, 2024, to continue making transactions on their accounts. This requirement is mandatory for all electronic payment services. Customers must provide a copy of their valid identification document, such as a driver's license, voter card, or passport, and a facial photo (selfie). This process is essential for ensuring the security of all transactions and the legitimacy of account holders and in our aim to prevent identity theft, money laundering, financial fraud and other financial crimes.

After July 1st, verified accounts can perform all transactions, while limited accounts will only be able to log in to check their balance, change PIN and make one unique P2P transaction or one unique cashout to retrieve their remaining balance.

To check if your account is identified, dial *202#, then select option 5, then number 3. If the type is "Level 1," it means your account is ready to operate. If it is "Level 0," you need to follow the registration procedure by providing a valid ID. Alternatively, you can check the status in the MonCash app by tapping on your initials or photo in the profile button.

If your account is not identified by July 1, 2024, your MonCash mini wallet with a limit of 10,000 HTG will be "limited," preventing you from performing usual transactions such as cash in to deposit money in your account, cashing out money, receiving funds from other users, sending money, and paying bills.

Yes, MonCash will send notifications via SMS from official numbers saying that your identification process has been completed.

Yes, you should always consider the fee when calculating the amount you wish to withdraw to ensure you have sufficient funds in your account to cover both the withdrawal amount and the associated fee. However, you can always send the amount via P2P by scanning a MonCash QR code without any fees.

If you do not have enough money in your account to cover the fee, the transaction will not be processed. You can always call 202 and request help from the Customer Care team.

If you do not have a valid ID, you will not be able to complete the account identification process. As a result, your account may remain limited, restricting your ability to use our services.

If a family or friend sends you an international transfer and your account is not fully identified, you will receive an SMS notification indicating that you have a pending international transfer. To access these funds and have them credited to your MonCash account, you must complete the account identification process as required by MonCash. Alternatively, you can follow the instructions in the SMS to retrieve it.

No, if your account is limited you will not be able to receive money from other MonCash accounts or from abroad. You must complete the identification process to receive the funds.

No, you do not need to re-register. However, you will need to complete the identification process by providing a valid ID to lift the limitations on your account.

You can complete the identification process by:

Accepted identification documents include a Driver’s License, a Voter’s Card, or a Passport.

Identifying your MonCash account ensures that you can continue using all the services without interruption, enhances the security of your transactions, and helps protect against fraud and financial crimes. It also allows you to take full advantage of the services offered by MonCash.

If you do not identify your account by the deadline, your account will be restricted or "blocked," preventing you from performing standard transactions. To restore full access, you will need to complete the identification process.

You will receive a confirmation SMS or email from MonCash once your identification process is successfully completed. You can also check your account status in the MonCash app or by dialing *202# and following the prompts.

No, there is no cost to complete the identification process for your MonCash account. It is a mandatory and free process to ensure compliance with regulatory requirements.

Yes, you will be able to check your balance even if your account is limited.

MonCash employs robust security measures, including encryption and secure servers, to protect your identification information. Your data is handled in compliance with privacy regulations and is used solely for identification and compliance purposes.